Monitoring hedge fund positioning is critically important as a window into market dynamics, liquidity conditions, risk appetite, and potential asymmetries in future price moves.

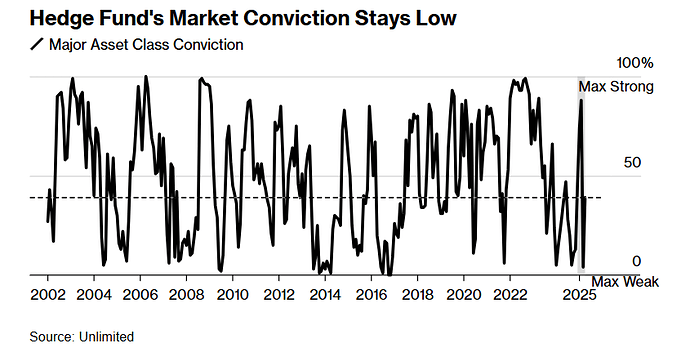

Positioning across major asset classes — including currencies, bonds and commodities — remains weak after having fallen at the end of March into the bottom 10th percentile relative to levels since 2000.

- In April, the only significant shift was their increased bets against US equities despite the recent market rebound

- Equity long-short managers are underweighting US stocks while adding to bets on Europe and Japan.

“What we’re seeing now is that fund managers are focusing more on policy than rhetoric — and the current set of policies in place is pretty unambiguously negative,” Elliott said in an interview. “The likely weakening of the economy is probably a much more important story than whatever Scott Bessent or Trump has to say on a minute-to-minute basis.”