Some real estate insights from Germany (will continue to add more if a found them):

- Prices could be stabilizing, but at the same time could be only because of low volume. A forced increase in supply could put additional pressure.

Compared with the previous quarter, Q1 2023, prices for apartments decline by 0.3 percent. Single-family house prices increase 2.3 percent, while multi-family house prices increase 1.8 percent.

Compared with the previous-year quarter, Q2 2022, all housing segments are still down sharply. Apartment prices are down 9.9 percent in comparison, single-family house prices are down 10.5 percent, and multi-family house prices are down 20.9 percent.

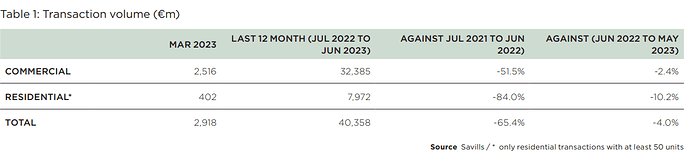

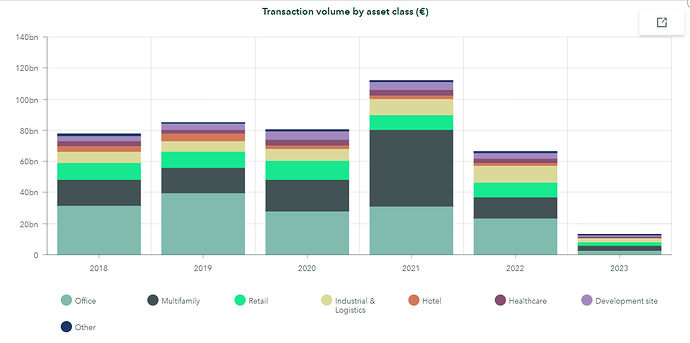

- Investment transaction volumes continued to be low Q2 2023.

Activity on the German real estate investment market stabilized in the 2nd quarter of the year but remained exceptionally low. For the 1st half of 2023, the transaction volume totaled approx. €13.3bn. This is about two-thirds less than in the same period of the previous year and at the same time the lowest turnover of a 1st half-year since 2011.

.

- Other source with similar results:

We are now setting our 2023 forecast for the transaction volume at €40 billion. This would roughly correspond to the 2012 result and would be around 47 per cent below the 10-year average.

- Residential market also with very low volume

Residential transaction volume (more than 50 units) amounted to approximately €3.1bn in the first half of 2023 – more than 60% less than in the same period of the previous year, with the second quarter being the weakest in terms of sales since 2011. The outlook to the end of 2023 is very subdued: Transaction volumes will be well below the long-term averages of €15.8bn (5 years) and €14.7bn (10 years)

- Building Permits and construction activity still in contraction.