Main Article: Purchasing Managers Index: Europe - InvestmentWiki

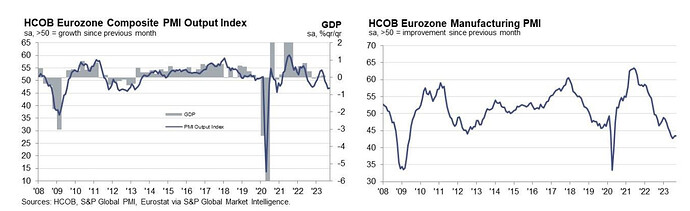

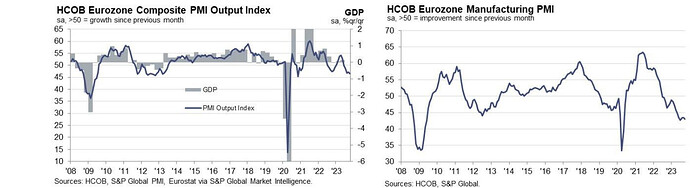

Eurozone business activity contracted at an accelerating pace in August as the region’s downturn spread further from manufacturing to services. Both sectors reported falling output and new orders, albeit with the goods-producing sector registering by far the sharper rates of decline. Hiring came close to stalling as companies grew more reluctant to expand capacity in the face of deteriorating demand and gloomier prospects for the year ahead, the latter sliding to the lowest seen so far this year

- HCOB Flash Eurozone Composite PMI Output Index at 47.0 (July: 48.6). 33-month low.

- HCOB Flash Eurozone Services PMI Business Activity Index at 48.3 (July: 50.9). 30-month low.

- HCOB Flash Eurozone Manufacturing PMI Output Index at 43.7 (July: 42.7). 2-month high.

- HCOB Flash Eurozone Manufacturing PMI at 43.7 (July: 42.7). 3-month high.

“The service sector of the eurozone is unfortunately showing signs of turning down to match the poor performance of manufacturing. Indeed, service companies reported shrinking activity for the first time since the end of last year, while output in manufacturing dropped again. Considering the PMI figures in our GDP nowcast leads us to the conclusion that the eurozone will shrink by 0.2% in the third quarter.”

“ECB president Christine Lagarde sounded the alarm that the economy may be faced with higher wages and lower productivity, leading to higher inflation. It seems like those worries are about to turn into reality, at least for the vast service sector. For, in this sector input prices and thus wages increased at an accelerated pace in August. Meanwhile, stagnating employment combines with decreasing production and results therefore in lower output per head. As a result, the ECB may be more reluctant to pause the hiking cycle in September.”

https://www.pmi.spglobal.com/Public/Home/PressRelease/47840ba665f24e19b896088b4d160c6b

I think we should get all the same economic indicators that we are following in the U.S. for the eurozone as well like e.g. jobs numbers, corporate health in order to make it easier to see the full picture.

Final August PMI numbers, it does not look good for Europe with slower economy activity but input prices increasing again. Stagflation is the worst of both worlds probably.

- HCOB Eurozone Composite PMI Output Index at 46.7 (Jul: 48.6). 33-month low.

- HCOB Eurozone Services PMI Business Activity Index at 47.9 (Jul: 50.9). 30-month low

- HCOB Eurozone Manufacturing PMI Output Index at 43.4 (Jul: 42.7). 2-month high

- HCOB Eurozone Manufacturing PMI at 43.5 (Jul: 42.7). 3-month high

- Input price inflation accelerates for first time in nearly a year

“The eurozone didn’t slip into recession in the first part of the year, but the second half will present a greater challenge. For, the once stabilizing services sector turned into a drag for the economy while manufacturing has not bottomed out yet, most probably. The disappointing numbers contributed to a downward revision of our GDP nowcast which stands now at -0.1% for the third quarter.

Input price increases surprisingly picked up putting the perspective of rapidly decreasing inflation into question. The prime suspect is likely the wage hikes, which are not necessarily in sync with the business cycle, given their often longer term nature. Employers weren’t too keen on beefing up their teams. The way things have been going down lately, it’s a sign they’ll be moving towards job cuts sooner, not later. Still, the decline in unfinished tasks and new orders doesn’t seem severe enough at this point to trigger aggressive cuts.

https://www.pmi.spglobal.com/Public/Home/PressRelease/382c7872528a4f48bf03911ae648e7f1

Highest total of sectors to have recorded a drop in output since May 2020 and signalled a narrowing in the sectoral divergence that has been apparent in the previous few months.

- Trends for new orders took a similarly gloomy turn as demand weakness previously confined to the manufacturing sectors spread to services.

- In terms of employment, an increasing number of industries noted job losses. Only seven of the 20 monitored sectors registered an increase in employment levels during August, the lowest total in 33 months.

https://www.pmi.spglobal.com/Public/Home/PressRelease/04c5d54808f64f0daad11adf6370f482

The contraction in Eurozone is also becoming broader, with the services sector slowing too. GDP is forecasted to be -0.4% Q/Q.

- New orders at the lowest level November 2020, especially for services sector.

- Employment rose marginally in September, the rate of job creation was the joint second slowest in the current 32-month sequence of growth

- A sharp rise in input costs contrasted with a softer pace of output price inflation, probably squeezing margins.

- France is catching up with Germany in their weakness.

The eurozone private sector remained in contraction at the end of the third quarter of the year as waning demand led to a further decline in activity. The overall reduction in output was again led by manufacturing, but the service sector saw activity decrease for the second month running. Although firms continued to expand their staffing levels in September, the rate of job creation was only marginal amid evidence of spare capacity and the gloomiest outlook since the final quarter of last year.

- HCOB Flash Eurozone Composite PMI Output Index (1) at 47.1 (August: 46.7). 2-month high.

- HCOB Flash Eurozone Services PMI Business Activity Index(2) at 48.4 (August: 47.9). 2-month high.

- HCOB Flash Eurozone Manufacturing PMI Output Index(4) at 43.4 (August: 43.4). Unchanged rate of decline.

- HCOB Flash Eurozone Manufacturing PMI(3) at 43.4 (August: 43.5). 2-month low

“The numbers for PMI services in the Eurozone paint a grim picture, but it’s not all doom and gloom. Sure, activity has been reduced once again and new incoming business has been shrinking for three months in a row. However, companies are hiring in September at a somewhat faster pace than they did in August. Thus, companies still show some resilience and optimism in the face of lower demand. Having said this, we expect the eurozone to enter a contraction in the third quarter. Our nowcast, which incorporates the PMI indices, points to a drop of 0.4% compared to the second quarter.

“The Eurozone’s HCOB PMI figures for services are serving up a bitter pill for the European Central Bank to swallow. The input prices, where wages play an important role, have sped up in September for the second month in a row. Output prices continue to be on the increase as well, but upward pressure has softened a bit again. While the latter may bring some comfort to central bankers, the heat on input prices shows that the risk of a wage-price spiral must remain very much on the radar of the ECB.

“The main drag continues to come from manufacturing where the order situation deteriorated further. Companies keep reducing the stock of purchased goods. However, the declines in purchasing activity have lost some momentum. Thus, the destocking process may bottom out over the next few months in line with a worldwide trend. This will be an important precondition for the recovery of the manufacturing sector which we expect for the beginning of next year.

https://www.pmi.spglobal.com/Public/Home/PressRelease/a068624fcdde4a06b7b68d0afe07bdc3

Private sector output declining at the steepest rate for over a decade if pandemic-affected months are excluded. New orders also fell at an accelerating rate, pointing to a worsening demand environment for both goods and services. Companies cut employment as a result, representing the first drop in headcounts since the lockdowns of early 2021, and remained focused on cost-cutting inventory management.

- Composite PMI Output Index at 46.5 (September: 47.2). 35-month low.

- Services PMI Business Activity Index at 47.8 (September: 48.7). 32-month low.

- Manufacturing PMI Output Index at 43.1 (September: 43.1). Unchanged rate of decline.

- Eurozone Manufacturing PMI at 43.0 (September: 43.4). 3-month low.

Mild Recession expected in Eurozone

In the Eurozone, things are moving from bad to worse. Manufacturing has been in a slump for sixteen months, services for three, and both PMI headline indices just took another hit. In addition, all subindices point very consistently downwards, too, with only a few exceptions. Overall, this points to another lacklustre quarter. We wouldn’t be caught off guard to see a mild recession in the Eurozone in the second half of this year with two back to back quarters of negative growth.

Services falling rapidly into contraction now too

The composite PMI fell to 46.5, with the downwards movement in the index driven mostly by service activity which is on a steeper downward slope than the previous month. The unrelenting slide in new and outstanding business is a red flag, signalling more trouble ahead for this sector.

Job losses have started, but still very mild, due to structural shortage not expected to be very bad

Service providers’ hiring came almost to a standstill. Manufacturing companies are not just continuing to cut staff, they are ramping up job shedding plans. This led for the first time since January 2021 to an overall decrease in employment according to the composite PMI. Having said this, the reduction has been mild and given the structural shortage of labour we are not expecting the jobless numbers to spike up all that much in the near future.

Inflation is still not something ECB can relax about even with the economic weakness

Price increases in the services sector remain very high in October, the more so if you measure it against previous economic rough patches. There has been only a slight slowing down of inflation in both input prices and prices charged. For the European Central Bank, these figures reinforce the case of a pause in the interest rate cycle instead of thinking aloud about loosening monetary policy

https://www.pmi.spglobal.com/Public/Home/PressRelease/8dc7347e38ad43e88d81531f437243aa

Eurozone economy continues to contract (at 47.1) according to the PMI, however the decline has been softening in recent months.

- Business activity in the euro area continued to fall during November, according to provisional PMI survey data, amid a further solid decline in new orders.

The Eurozone economy is stuck in the mud. Over the last four to five months, the manufacturing and services sectors have both been experiencing a relatively constant contraction pace. Considering the flash PMI numbers for November in our nowcast model indicates the potential for a second consecutive quarter of shrinking GDP. This would align with the commonly accepted criterion for a technical recession.

- Job cuts for the first time since the start of 2021

The economic weakness, initially impacting industrial workers’ jobs by mid-2023, is now poised to reach the services sector jobs market. Employment growth in this domain has nearly come to standstill. Anticipating a continued downward trend for the next few months, there is a possibility of an uptick in the unemployment rate, which has shown resilience thus far.

- Service prices continue to increase, fueled by increases in input cost. While manufacturing prices continue to decline.

This is certainly not what the ECB likes to see. Despite the prevailing economic weakness, service providers continue to forge ahead with faster price increases in November, propelled by the astonishingly rapid and even accelerating increase in input costs. The latter can be mostly attributed to above average increases in wages, which play a major role in the services sector.

https://www.pmi.spglobal.com/Public/Home/PressRelease/20d35936ba1e4c8cac284d0a18afceef

Business activity in the euro area fell at a steeper rate in December, closing off a fourth quarter which has seen output fall at its fastest rate for 11 years barring only the early-2020 pandemic months.

Once again, the figures paint a disheartening picture as the Eurozone economy fails to display any distinct signs of recovery. On the contrary, it has contracted for six straight months. The likelihood of the Eurozone being in a recession since the third quarter remains notably high.

- Downturns were again recorded across both manufacturing and services, with both sectors reporting further steep falls in inflows of new business, which led to a further depletion of backlogs of work.

The service sector maintains a relatively more stable position compared to the manufacturing sector, contracting at a much slower rate. This is likely attributed to the concurrent reduction in consumer price inflation, coupled with an above-average surge in wages. However, despite these elements, there are no indications of the service sector breaking free from its unsatisfactory trajectory. Quite the opposite, new business is diminishing at an accelerated pace, as is the backlog of work.

- Jobs were cut for a second month running as firms scaled back operating capacity in line with the worsening order book situation and persistent gloomy prospects for the year ahead, with future sentiment remaining well below its long-run average despite lifting slightly higher.

The coexistence of declining output and unchanged employment levels signals an exacerbation of productivity challenges. Consequently, the anticipated streamlining effect, typical of past recessions providing the basis for productivity increases, seems unlikely to materialize this time. This factor contributes to our expectation of only modest economic growth in the Eurozone, forecasted at 0.8% for the upcoming year, following 0.5% growth this year.

- Inflation signals were mixed: input cost inflation cooled but selling price inflation accelerated, the latter notably remaining elevated by historical standards.

Even though input prices increased at a modestly slower rate, companies were able to raise output prices even more than in previous months. This suggests that businesses were successful in transferring a portion of the cost increases to customers

https://www.pmi.spglobal.com/Public/Home/PressRelease/03f071373b244d71b8437ef891e0ede6

The downturn in the eurozone economy stretched into the final month of 2023, December PMI

extending the contraction seen since June. Demand for euro area goods and services continued to weaken while employment levels fell again, just the second time this has been the case in almost three years.

The service sector across the Eurozone is experiencing a slight contraction, much like it did in

November, while job numbers are still ticking up, albeit marginally. It’s not quite recession territory yet for services, but the vibe is far from growth-oriented. There are a lack of clear signals indicating an imminent return to robust expansion.

The Composite PMI, a reliable indicator of overall economic performance, is sounding the recession alarm for the Eurozone, though. Adding weight to this observation is our GDP Nowcast model, which forecasts a back-to-back contraction in the region’s output for the fourth quarter.

In the face of a stagnant services sector, it’s impressive that service providers are successfully transferring a portion of their growing input costs to customers. Sales prices, in fact, saw a noticeable increase in December, and at a slightly elevated pace. This will go against those members of the European Central Bank who are inclined to cut rates already in March. We expect a first rate cut in June.

https://www.pmi.spglobal.com/Public/Home/PressRelease/e261c402e9bf4abe9034d99766aa950a

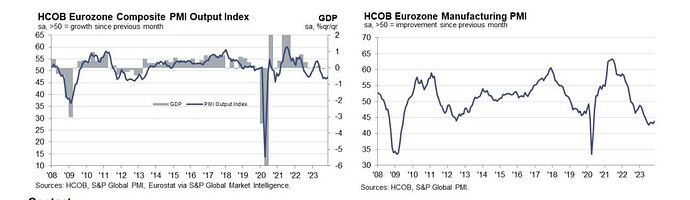

Mixed picture for the eurozone: while the manufacturing sector continues to shrink, the services sector is showing signs of improvement after six months of decline.

There is a glimmer of hope as the eurozone inches towards recovery. This is particularly noticeable in the services sector.

The corresponding HCOB PMI is now 50 points and has therefore stopped shrinking for the first time since July last year. The latest PMI print gives hope for a recovery in the eurozone, which is why we are sticking to our annual HCOB forecast of 0.8% for 2024. There is also a certain optimism in the latest employment figures, which rose at a faster pace than in the previous month.

The manufacturing sector is the drag on the European economy. That is clearly demonstrated by the sharp decline in production and the drag on new orders. Accordingly, the companies surveyed have further reduced their workforce and the

business outlook for the coming twelve months remains below the long-term average, which tends to reflect pessimism

The most concerning from this release is the continued pressure on prices, especially for services sector.

Germany still struggling significantly.

Germany is acting as a brake on eurozone growth. While France is recovering more strongly in both the services and manufacturing sectors, Germany is lagging behind. The services export sector in particular boosted France in February, while it slowed down Germany. One possible explanation for this could be increased tourism activity, which benefits France more than Germany.

https://www.pmi.spglobal.com/Public/Home/PressRelease/0cc1e87a13544d93b96af49c670b5f72

EU economic activity continues more or less the same with a weak manufacturing sector, but a still expanding services sector supporting growth.

- Composite PMI Output Index (1) at 49.9 (February: 49.2). 9-month high.

- Services PMI Business Activity Index(2) at 51.1 (February: 50.2). 9-month high.

- Manufacturing PMI Output Index(4) at 46.8 (February: 46.6). 11-month high.

- Manufacturing PMI(3) at 45.7 (February: 46.5). 3-month low.

If you were hoping for a recovery in the manufacturing sector in the first quarter, it’s time to throw in the towel. The March PMI confirmed the clear weakness of this sector, which seems to be dominated by the heavyweight Germany

These are the times that make you humble and where a modest monthly expansion is already good news. In this sense, the fact that the services PMI moved further into expansionary territory at 51.1 should be seen as a positive development, especially as it marks the second consecutive month of growth.

Service sector input cost and selling price inflation rates meanwhile remained elevated by historical standards due to higher wage costs, though a cooling in the pace of increase in cost burdens was recorded to take some pressure off overall selling price inflation.

The European Central Bank can take some comfort from the fact that price pressures in the wage-sensitive services sector have not increased further. Instead, the rise in input costs has softened somewhat, and the same is true of selling prices. However, price pressures remain elevated. Therefore, the PMI price news is not enough to change the ECB’s apparent plan to cut rates in June rather than April.

https://www.pmi.spglobal.com/Public/Home/PressRelease/81953eba38c14ecfba77a05e3de050df

The slight recovery in the Eurozone economy continued in April, supported especially by the services sector since manufacturing sector continues to be weak.

Business activity in the euro area grew at the fastest rate for nearly a year in April. Increasingly robust service sector growth was nevertheless accompanied by signs of a further moderation of the manufacturing downturn

Considering various factors including the HCOB PMIs, our GDP forecast suggests a 0.3% expansion in the second quarter, matching the growth rate seen in the first quarter, both measured against the preceding quarter.

The negative comes from prices, experiencing slightly higher pressure currently, also driven by the services sector

- Price pressures intensified slightly in April, remaining elevated by pre-pandemic standards, with higher rates of inflation seen for both input costs and average selling prices

The PMI figures are poised to test the ECB’s willingness to cut interest rates in June. Accelerated increases in input costs, likely driven not only by higher oil prices but also, more concerningly, by higher wages, are a cause for scrutiny. Concurrently, service sector companies have raised their prices at a faster rate than in March, fuelling expectations that services inflation will persist. Despite these factors, we expect the ECB to cut rates in June

https://www.pmi.spglobal.com/Public/Home/PressRelease/ff347c6171cd47edb8e2609b98d5a741

The eurozone economy continues to pick up momentum in may, being driven especially by the services economy, but manufacturing also continues to get better in its rate of contraction.

A stronger or at least resilient economy I think would allow the ECB to ease less while the FED holds rates too.

- Composite PMI Output Index(1) at 52.3 (April: 51.7). 12-month high.

- Services PMI Business Activity Index(2) at 53.3 (April: 53.3). Unchanged pace of growth.

- Manufacturing PMI Output Index(4) at 49.6 (April: 47.3). 14-month high.

- Manufacturing PMI(3) at 47.4 (April: 45.7). 15-month high.

“This looks as good as it could be. The PMI composite for May indicates growth for three months straight and that the eurozone’s economy is gathering further strength. Encouragingly, new orders are growing at a healthy rate while the companies’ confidence is reflected by a steady hiring pace.

We are heading in the right direction. Considering the PMI numbers in our GDP nowcast, the Eurozone will probably grow at a rate of 0.3% during the second quarter, putting aside the spectre of recession. Growth is mainly driven by the service sector whose expansion was extended to four months. Manufacturing acts less and less as a stumbling block for the economy and optimism about future output has increased further in this sector.

Rates of inflation of both input costs and output prices eased in May, but in each case remained above the pre-pandemic average

There is also some good news for the European Central Bank (ECB) as the rates of inflation for input and output prices in the services sector has softened compared to the month before. This will be supportive for the apparent stance of the ECB to cut rates at the meeting on June 6. However, the better inflation outlook will be most probably not be enough for the central bank to announce that further rate cuts will follow suit.

https://www.pmi.spglobal.com/Public/Home/PressRelease/ddb44fcf338b4884b39a3f01e4803d70

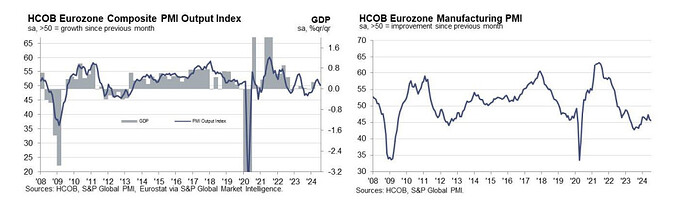

July 2024: data signaled a near-stagnation of the eurozone private sector

This is mostly due to a broader downturn in manufacturing activity, driven by decreases in new orders, production, and inventories. The new orders experienced a particularly sharp drop, impacting overall output.

- Employment: The manufacturing sector saw the highest job cuts in 2024. Service sector employment growth slowed, reflecting reduced business confidence and falling new orders.

- Inflation: Input prices rose sharply, especially in the service sector, reaching a three-month high. Despite rising costs, companies faced limited pricing power due to weak demand, leading to only modest increases in output prices.

- Demand Weakness: New orders are down for the second month, with export orders falling for the 29th consecutive month, reflecting difficulties in securing international sales.

It feels a bit like it as the Eurozone economy barely moved in July, according to the HCOB Flash Eurozone PMI. But beside the fact that we are talking about seasonally adjusted figures, looking at the two monitored sectors the situation deteriorated significantly in the manufacturing sector and counteracted moderate growth in the services sector. According to our GDP Nowcast, growth in the third quarter is still on the cards, however.

https://www.pmi.spglobal.com/Public/Home/PressRelease/566793e1194e4d55a9b020fbd612ae4d

September 2024: September saw a renewed decline in business activity in the eurozone private sector

The Composite PMI for the Eurozone fell to 48.9 in September (from 51.0 in August), marking the first decrease in business activity in seven months.

The eurozone is heading towards stagnation. After the Olympic effect had temporarily boosted France, the eurozone heavyweight economy, the Composite PMI fell in September to the largest extent in 15 months. The index has now dipped below the expansionary threshold. Considering the rapid decline in new orders and the order backlog, it doesn’t take much imagination to foresee a further weakening of the economy.

With the ECB closely watching the persistently high inflation in services, the news that both input and output price inflation has slowed down is certainly welcome. Add to that the deepening recession in manufacturing and the near-stagnation of the services sector, and the possibility of another rate cut in October could very well be on the table, even though this is not the expectation of the market yet

Companies reduced staff for the second consecutive month, with the sharpest cuts seen in manufacturing since August 2020. Employment in the services sector slowed significantly.

We expect the official employment figures in the eurozone, which have remained stable so far, to worsen in the coming months, though demographic trends should provide more stability than in previous downturns.

https://www.pmi.spglobal.com/Public/Home/PressRelease/cf25d7bb494046ae9256a00ca028f09a

November 2024: Renewed fall in Eurozone business activity as services joins manufacturing in contraction

- The Composite PMI Output Index fell to 48.1 from 50.0 in October, a 10-month low.

- Both the services (49.2) and manufacturing sectors (45.1) are now in contraction, with the latter declining for the 20th consecutive month.

Things could hardly have turned out much worse. The eurozone’s manufacturing sector is sinking deeper into recession, and now the services sector is starting to struggle after two months of marginal growth. It is no surprise really, given the political mess in the biggest eurozone economies lately – France’s government is on shaky ground, and Germany’s heading for early elections. Throw in the election of Donald Trump as US president, and it is no wonder the economy is facing challenges. Businesses are just navigating by sight.

The services sector took an unexpected dive, with activity dropping for the first time since January. We thought that lower inflation and higher wages would boost consumption and demand for services, but that hope has been dashed. It doesn’t look like a recovery is coming anytime soon since both new orders and order backlogs have fallen even faster than in October.

Stagflarionary risks are starting to emerge, due to pressure from wages, and potential retaliatory tariffs against the US.

- The rate of input cost inflation quickened to a three-month high in November, but was still slower than the average over 2024

so far - Output prices also rose at a pace that was faster than in October but softer than on average across the opening 11 months of

the year

The environment in November is stagflationary. On one hand, activity is declining across the board, while on the other, input and output prices are rising more quickly. This surge is driven by services costs, which ties in with the sharp rise in wages in the eurozone in the third quarter. Service sector selling price inflation is a major headache for the ECB. Given this backdrop,

some ECB members might even argue for a rate pause in December, but most will probably stick with a 25-basis point rate cut.In November, manufacturing purchase prices didn’t drop as much as the previous month. If the euro keeps weakening, purchase prices might even rise in the coming months, especially if the EU Commission imposes counter-tariffs in response to potential US tariff hikes.

https://www.pmi.spglobal.com/Public/Home/PressRelease/318dcff6eaaf4b77aa8f57cc02b2a613