This topic will focus on updates and developments in European consumer spending an debt, and the implications it can have within the economy and individual industries.

Consumer spending in Europe has been weak being down most of 2023, and according to analysts, it is one of the factors that is needed to get better for a sustained economic recovery in the region.

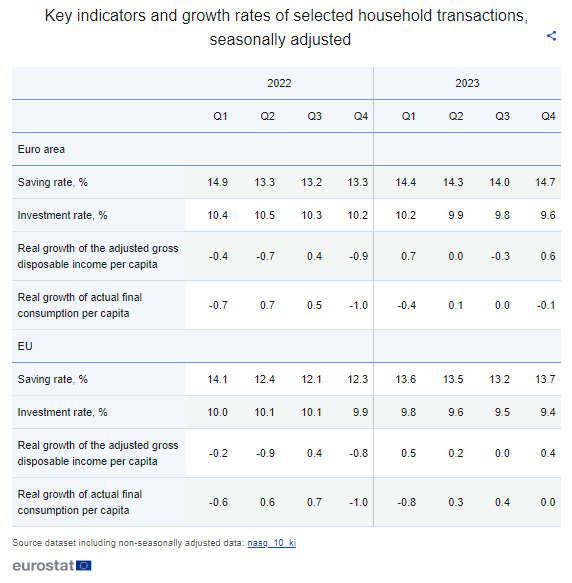

Contrary to the US, the Eurozone consumer is more prone to save, and the savings rate in the EU is currently higher than before 2019, and was only this high inside the 2008 financial crisis.

With the ECB expected to gradually cut rates, some savings incentives will disappear, which could fuel spending.

The household investment rate ( ratio of gross fixed capital formation (mainly dwellings) by households to their gross disposable income) has instead been decreasing.

Loans to households which is another source for consumer spending has been down since October 2022, but have stabilized recently.

Despite the increase in loans, the assets to liabilities are still significantly better than in 2019.

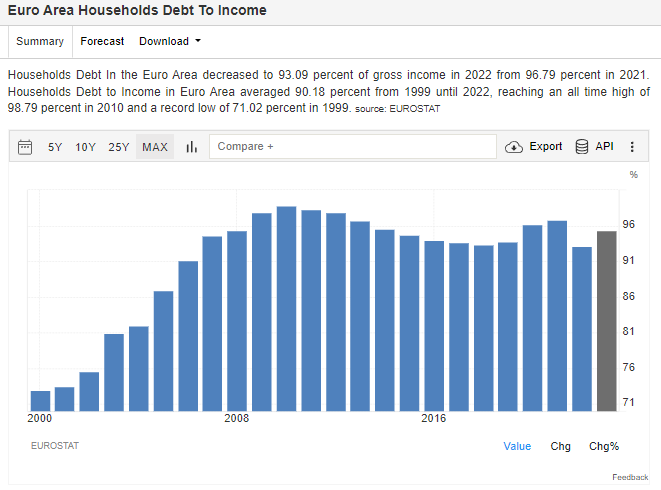

The eurozone debt-to-income ratio is worse than that of the US, which could signal less long-term run away for the consumer