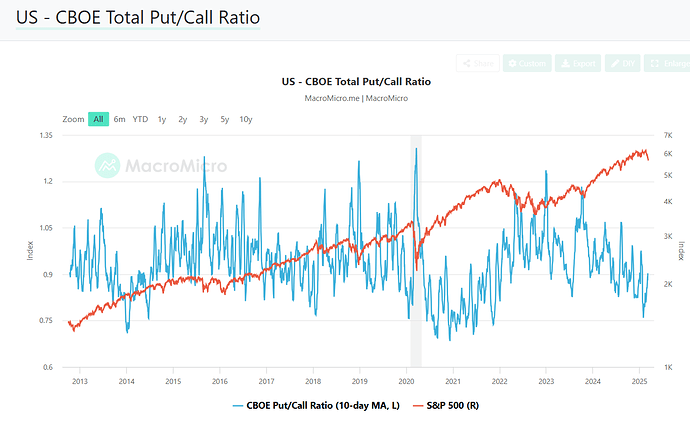

The equity put-call ratio (PCR) is a widely used market sentiment indicator derived from options trading. It measures the volume (or open interest) of put options relative to call options in the equity market.

- Put options: Represent bearish bets (expecting a price decline).

- Call options: Represent bullish bets (expecting a price increase).

Why Is the Equity Put-Call Ratio Important?

The PCR serves as a contrarian sentiment indicator:

- Low PCR (more calls than puts) → Indicates excessive optimism (potential overbought conditions).

- High PCR (more puts than calls) → Indicates excessive pessimism (potential oversold conditions).

Institutional traders and analysts monitor PCR to gauge market sentiment, potential reversals, and risk appetite.

Interpretation of Movements

A. High Put-Call Ratio (Above 1.0) → Bearish or Contrarian Bullish?

- A high PCR suggests that traders are heavily buying puts, expecting a market decline.

- However, extreme pessimism can signal a contrarian buying opportunity—if too many investors are hedging against a fall, it might indicate that selling is overdone.

- Example: PCR spikes above 1.2–1.5 during extreme fear (e.g., March 2020 COVID-19 crash).

B. Low Put-Call Ratio (Below 0.7) → Bullish or Contrarian Bearish?

- A low PCR suggests excessive call buying, which typically indicates strong bullish sentiment.

- However, excessive optimism often leads to overbought conditions, signaling a potential correction.

- Example: PCR below 0.5 has historically preceded short-term market tops.

C. Neutral Put-Call Ratio (~0.7 to 1.0)

- Indicates balanced sentiment, often seen in stable or consolidating markets.