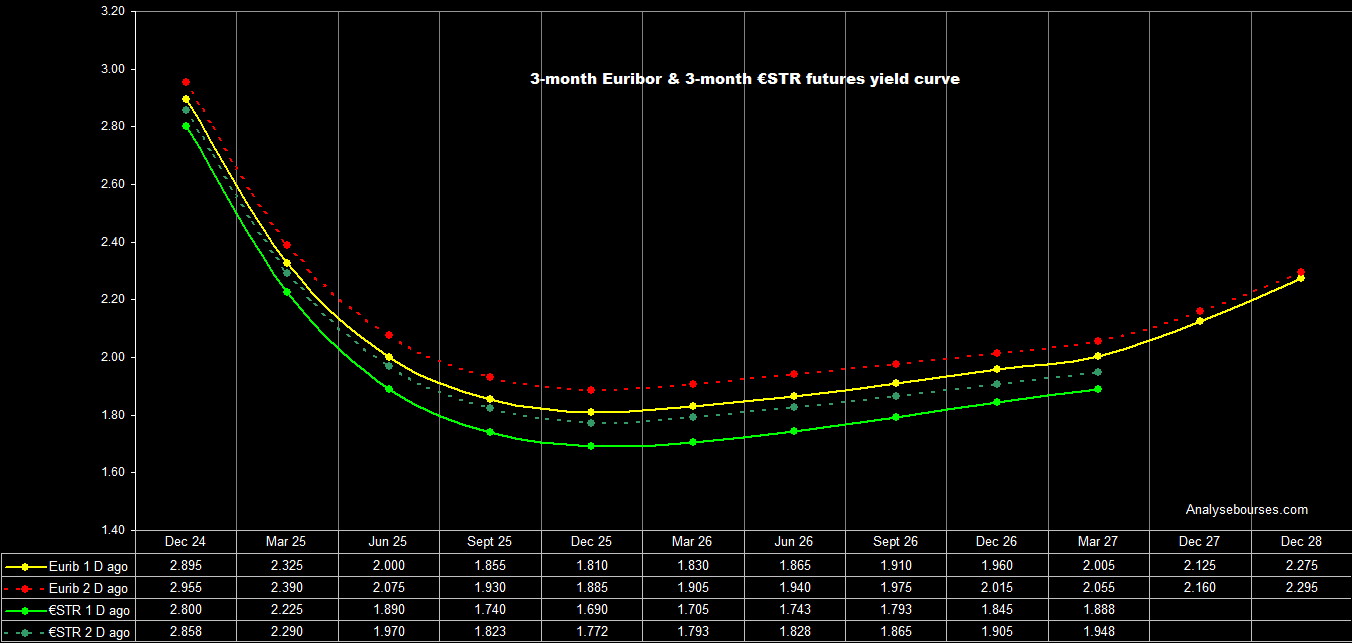

Amid recent weak economic data from Europe, futures markets are now anticipating significant monetary easing over the next two years. EURIBOR is projected to bottom out around 1.8% by the end of 2025, before stabilizing near 2% thereafter.

This suggests that markets have priced in approximately 225 basis points of rate cuts from the ECB from the peak, and 175bps more to come.

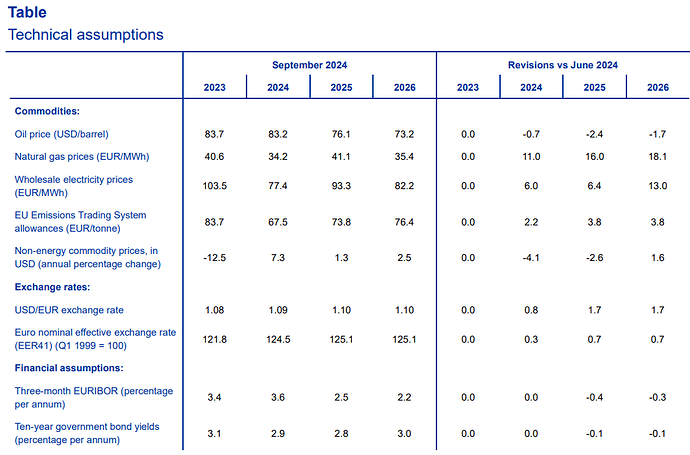

The ECB in its latest projections is forecasting 3M EURIBOR to reach 2.5% in 2025 and 2.2% in 2026.

So the market is currently pricing more (50bps) and faster rate cuts.

I don’t have enough knowledge about the European economy to know with high certainty the most likely path, but due to my expectations of a weaker economy, I would not be surprised to see rates in the 1.50-1.75% range in the next 2 years.