This topic has the aimed to discuss the path of monetary policy in the Euro Area

Lagarde still sounding very hawkish, despite some weakness I have heard in Europe economy. Expects furthers hikes

“Lagarde said the initial phase of inflation, in which the cost of supply shocks in energy and other commodity markets was passed on to consumers by companies, was fading. But a second phase driven by rising labour costs had emerged, with eurozone wages forecast to climb 14 per cent by 2025.”

The ECB expects companies’ profit margins to fall because of rising labour costs. But if they avoid a quarter of these margin losses it would keep inflation at almost 3 per cent in 2025, Lagarde estimated.

Goldman Sachs analysts said in a note to clients that Lagarde’s “fairly hawkish” comments suggested there could still be some “distance until the ECB reaches its peak rate”, adding: “Rather than viewing weaker growth as exacerbating the policy trade-off, the ECB sees it as the means by which inflation will come down.”

I really think the ECB do a better job explaining what they are expecting than the FED.

Powell always gives the same statement, which is annoying.

Some insights:

-

The first phase was led by firms, which reacted to steeply rising input costs by defending their margins and passing on the cost increases to consumers. The intensity of this reaction was unusual, unit profits contributed around two-thirds to domestic inflation in 2022, whereas in the previous 20 years their average contribution had been around one-third.

-

But the second phase of the inflation process is now starting to become stronger. Workers have so far lost out from the inflation shock, seeing large real wage declines, which is triggering a sustained wage “catch-up” process as they try to recover their losses. In our latest projections, we expect wages to grow by a further 14% between now and the end of 2025 and to fully recover their pre-pandemic level in real terms.

-

The effect on inflation from rising wages has recently been amplified by lower productivity growth than we had previously projected, which is leading to higher unit labour costs.

-

Must ensure that inflation expectations remain anchored as the wage catch-up process plays out. For this to happen, we need to ensure that firms absorb rising labour costs in margins. For instance, if firms were to regain 25% of the lost profit margin that our projections foresee, inflation in 2025 would be substantially higher than the baseline – at almost 3%.

-

Under these conditions, it is unlikely that in the near future the central bank will be able to state with full confidence that the peak rates have been reached.

Breaking the persistence of inflation

-

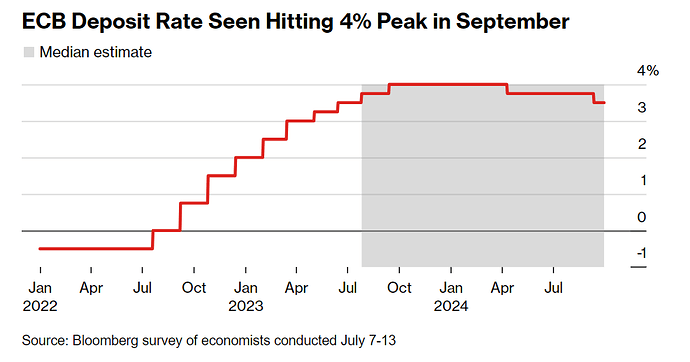

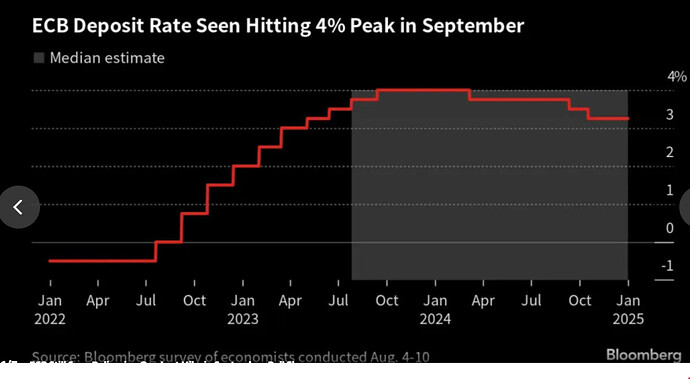

ECB is expected to hike interest rates by two more 25 basis points to a peak of 4% in September, higher than the previous expected peak of 3.75%.

-

First cut in interest rates is expected to come in April 2024.

SI=0%, I=7

-

ECB raises interest rate by 25 basis points taking its main rate to 3.75%.

“Inflation continues to decline but is still expected to remain too high for too long,” the ECB said in a statement.

-

The ECB kept options foe September meeting open.

The Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to the 2% medium-term target. The Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction," the statement added.

-

The rate hike was widely expected by the market.

Monetary policy decisions

https://www.cnbc.com/2023/07/27/ecb-rate-decision-july-2023-raises-rates-by-25-basis-points.html

Fewer profits and liquidity for banks, another monetary tightening in some sense.

The European Central Bank will stop paying banks for the money they are required to keep at the institution as a minimum reserve, a surprise move that could cut billions from lenders’ interest income.

Europe’s banks most recently were required to stash about 165 billion euros at the ECB as minimum reserves, according to data through June 20 on the central bank’s website. The central bank paid 3.25% on that amount, translating into annual income of about 5.4 billion euros ($6 billion).

ECB Scraps Interest on Minimum Reserve in Hit to Bank Income - Bloomberg

ECB adjusts remuneration of minimum reserves

According to Bloomberg poll of economists, the ECB is still expected to deliver one last rate hike in September.

ECB Still Seen Delivering One Last Hike in September, Poll Shows

Christine Lagarge’s speeches are always way better than those from Powell. I would recommend reading it. The transparency with which she talks about the mistakes their forecasts and hence monetary policy can have, even analyzing with research where those forecasts were wrong, makes me respects her more.

Summary:

She explained that after the pandemic the world is experiencing 3 major shifts, which could create an environment where the world will be prone to more supply-side shocks, and hence more long term inflation. This would create a totally difference environment for global markets than before the pandemic.

The 3 major shifts:

- Labour markets are historically tight across advanced economies, currently workers have greater bargaining power. Also, accelerated digitalization is likely to affect both the supply of workers and the composition of jobs.

- The energy transition, coupled with climate change, is reshaping global energy markets. Traditional suppliers are lowering production, altering the energy mix. This raises the potential for more frequent, significant supply shocks, with Oil and gas becoming less elastic, while renewables still face intermittency and storage challenges.

- A growing geopolitical split and economic fragmentation are occurring, leading to competing global blocs. This shift drives increased protectionism as nations adjust supply chains for strategic aims. Reshoring and friend-shoring may lead to supply limitations, particularly if trade fragmentation outpaces domestic rebuilding.

Supply-side shocks will prompt an upfront surge in investment that’s largely insensitive to the business cycle. This elevated structural investment will complicate economic predictions.

She explains we are still only in the beginning of this transition, and uncertain if these shifts will persist long term, or their definite consequences, making monetary policy more challenging. The ECB is planning to undergo it with 3 key elements:

- Being clear that price stability is a fundamental pillar of an investment-friendly environment. This will be crucial to keep inflation expectations firmly anchored even when there are temporary deviations from our target.

- Must be flexible in the fact that old models could work anymore, and will need to enhance the decision process by regularly updating the models and forecasting technologies with deeper analysis of the variables that act as the best leading indicators

- Should also be clear and humble about the limits of what we currently know and what policy can achieve. To maintain credibility with the public, there is a need to talk about the future in a way that better captures the uncertainty we face.

Policymaking in an age of shifts and breaks

I=8

-

ECB hikes interest rates by 25 basis points while pointing out that “Inflation continues to decline but is still expected to remain too high for too long.”

-

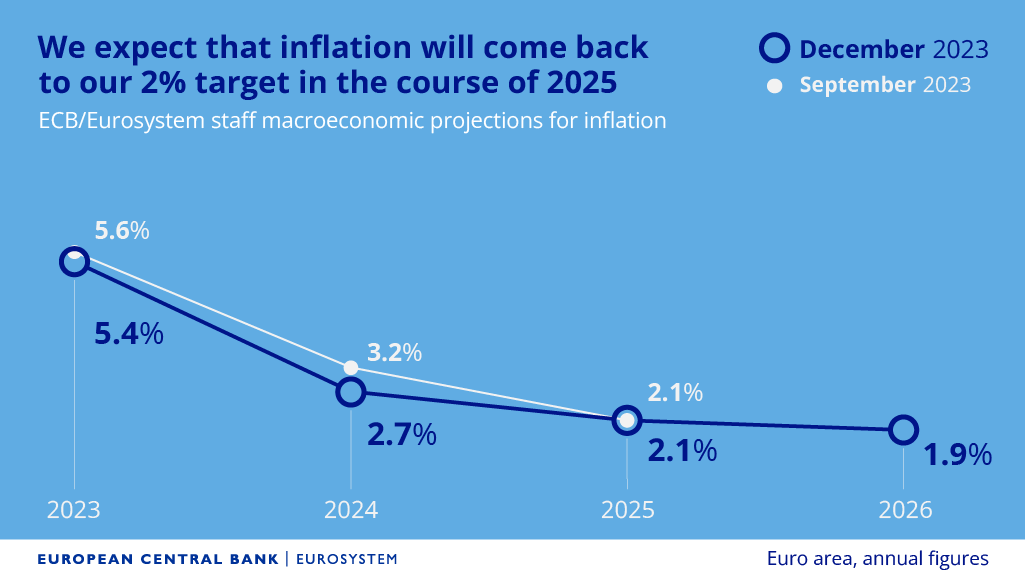

ECB said that the decision reflects an upward revision in macroeconomic projections, which sees inflation averaging 5.6% in 2023, 3.2% next year and 2.1% in 2025.

-

The policymakers signalled that the interest rates may now be at a level deemed as the peak and that future decisions will be informed by incoming data.

“Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target. The Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary. The Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction,” the statement said.

-

The market was largely divided on the ECB’s next move but by Thursday morning the prabability of an hike had risen to 63% following a Reuters article which said the ECB expects euro zone inflation to remain above 3% in 2024.

I heard the conference, and she avoided confirming this is the peak level and actually pointed out they are not saying they are now at peak, because they can’t say that with certainty. But what I understood is that with current data they think around this current level could be restrictive enough if sustained for sufficient time, but that they continue to be data dependent, and in case data justify it the level of the appropriate rates or duration could change.

I don’t think we will have certain policy guidance for some time.

I=7

- ECB holds interest rates steady, as was expected by the market.

- The deposit rate will remain at 4%.

- ECB said the “incoming information has broadly confirmed its previous assessment of the medium-term inflation outlook” for inflation to reach 2.0%.

Lagarde sounded quite hawkish, saying a pause does not mean they will not hike again, and that a rate cut is very premature to even be discussed. But, due to Europe’s weakness, especially if it continues, I think Europe could be closer to a rate cut than the US.

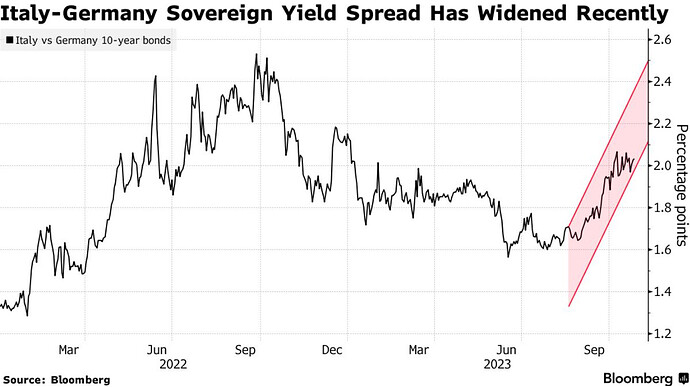

There was also a lot of focus before the meeting on the spread of the Itaian-Germany bonds, since it has widened a lot, and is reaching levels that are usually considered as a high risk.

But she did not say much about it, just that they have the tools to have a proper monetary transmission mechanism.

Italy’s 10-year bond yield is once again more than 200 basis points higher than its German equivalent, breaching a level commonly seen as a measure of heightened risk in the region. The danger should prompt ECB officials to shirk from a wind-down of their emergency pandemic purchase program, Subran observed.

“We see a selloff in Italian BTPs that is unheard of, and that is not going to get better with the fiscal credibility this government has chosen,” he told Manus Cranny and Dani Burger on Bloomberg Television. “What’s happening on the Italian spread is worrying, and we need to make sure we have some dry powder, should something happen.”

The ECB says that while they welcomed a declined in inflation until now, is still early to declare, and they will focus on this 3 factors to asses how inflation in going to develop going forward:

-

First, whether firms absorb rising wages in their profit margins, which would allow real wages to recover some of their past losses without the increase being fully passed through to inflation.

-

Second, whether there is some easing of labour market tightness, which would prevent excess demand for labour from becoming a driver of persistently high wage demands.

-

And third, that inflation expectations remain anchored, which ensures that, when the current shock passes, wage and price-setting will be guided by our 2% inflation target.

Monetary policy in the euro area: attentive and focused

I=6

-

ECB president Christine Lagarde said headline inflation is likely to rise again in the coming months and economic activity is likely to remain weak for the rest of the year.

“Looking ahead, we expect the weakening of inflationary pressures to continue, even though headline inflation may rise again slightly in the coming months, mainly owing to some base effects. However, the medium-term outlook for inflation remains surrounded by considerable uncertainty,” She said in a speech at the Hearing of the Committee on Economic and Monetary Affairs of the European Parliament.

-

She pointed out that wage pressure remains strong.

“Wage pressures, meanwhile, remain strong. Our current assessment is that this mainly reflects “catch-up” effects related to past inflation rather than a self-fulfilling dynamic. And we expect wages to continue to be a key factor driving domestic inflation.”

I=7

- ECB holds deposit rate steady at 4% (as was widely expected), saying that “inflation has dropped in recent months but is likely to pick up again temporarily in the near term.”

- The Governing Council said its future monetary decisions will continue to be informed by incoming data and that those decisions “will be set at sufficiently restrictive levels for as long as necessary.”

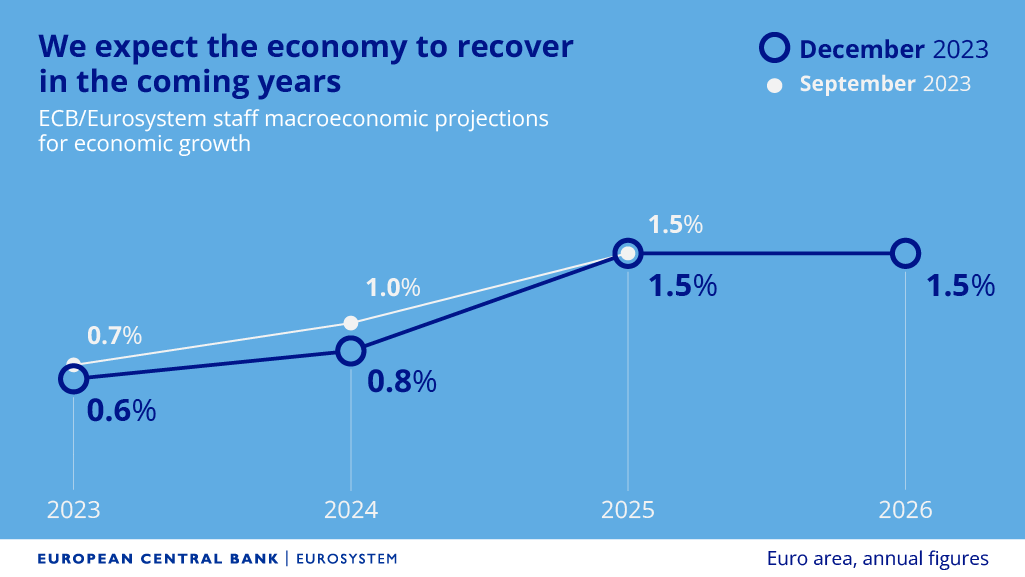

- ECB trimmed its 2023 and 2024 GDP forecasts from 0.7% to 0.6% and from 1% to 0.8%, respectively but left 2025 forecast unchanged.

- Headline inflation forecasts for 2023 and 2024 have also been lowered from 5.6% to 5.4% and from 3.2% to 2.7%, respectively while that for 2025 has been left unchanged at 2.1%.

I have heard from her conference, and even with Europe being much more weaker and probably closer to 2% target, the ECB says they have not even discussed rate cuts yet. Since they still see risks to the upside like geopolitical, weather events, and wage growth and profit margins more than expected.

So, yesterday’s FED tone is still weird to me.

Their forecast:

Same as the Fed, these forecasts are usually not accurate (Example

I=6

-

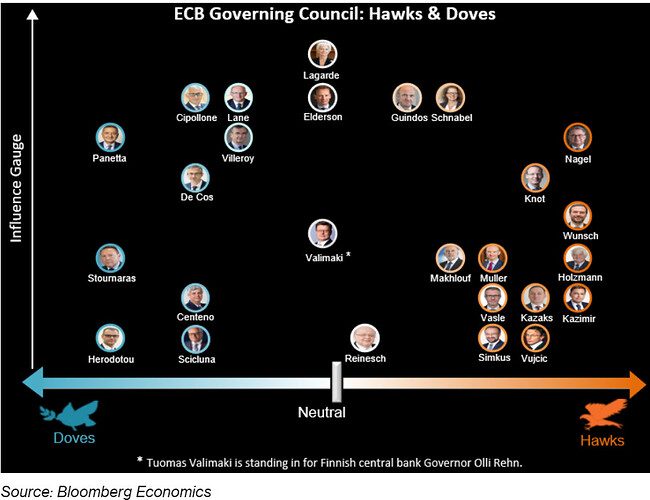

ECB’S Governing Council member Robert Holzmann doesn’t see rate cuts this year due to rising geopolitical tensions and lack of a clear decline towards the 2% target.

-

He reiterated a statement made by other members such as ECB President Christine Lagarde and Chief Economist Philip Lane that it’s too early to talk about rate cuts.

“The geopolitical threat has increased because what we saw until now by the Houthis — I think it’s not the end, it might be the overture to something much more broad based, which will impact the Suez Canal and increase the prices there,” Holzmann said Monday. “We should not bank on the rate cut at all for 2024.”

“Once such a date would be set, it would trigger immediately a dynamics which we cannot control,” said Holzmann.“And with all the knowledge we currently have, it would not be honest to do it because we don’t know how inflation will develop.”

-

Speaking at Davos, Bundesbank President Joachim Nagel also pointed out that it’s too early to talk about rate cuts.

“Maybe we can wait for the summer break or whatever but I don’t want to speculate,” he said in Davos. “I think it’s too early to talk about cuts.”

-

Both Holzmann and Nagel are considered ECB’s most hawkish members.

The Houthis situation I think can actually make central banks fearful to cut even if it’s needed, especially if it continues to be an ongoing threat.

I=6

-

ECB is likely to cut interest rates in summer, that’s according to its president Christine Lagarde.

“I would say it’s likely too,” Lagarde said. “But I have to be reserved, because we are also saying that we are data dependent, and that there is still a level of uncertainty and some indicators that are not anchored at the level where we would like to see them.”

-

However, she warned that agressive market bets on rate cuts are a distraction.

“It is not helping our fight against inflation, if the anticipation is such that they are way too high compared with what’s likely to happen,” Lagarde said.

-

She acknowledged that they are on the right path in inflation fight.

“We are on the right path, we are directionally towards the 2%, but unless and until we are confident that it is sustainably at 2% — medium term — and we have the data to support it, I’m not going to shout victory,” she said. “Not yet.”

https://www.bnnbloomberg.ca/lagarde-says-aggressive-rate-cut-bets-don-t-help-the-ecb-1.2022891

I=6

-

ECB held its deposit rate steady at 4%.

-

The statement said recent data has confirmed their medium-term outlook on inflation and a downward trend is beeing observed despite energy effects.

“The incoming information has broadly confirmed its previous assessment of the medium-term inflation outlook. Aside from an energy-related upward base effect on headline inflation, the declining trend in underlying inflation has continued, and the past interest rate increases keep being transmitted forcefully into financing conditions,” it said.

"The Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction,”it added.