Yes, they can trade Dt. Wohnen shares but only to an extent where such trading will not cause volatility or be construed as manipulating share prices.

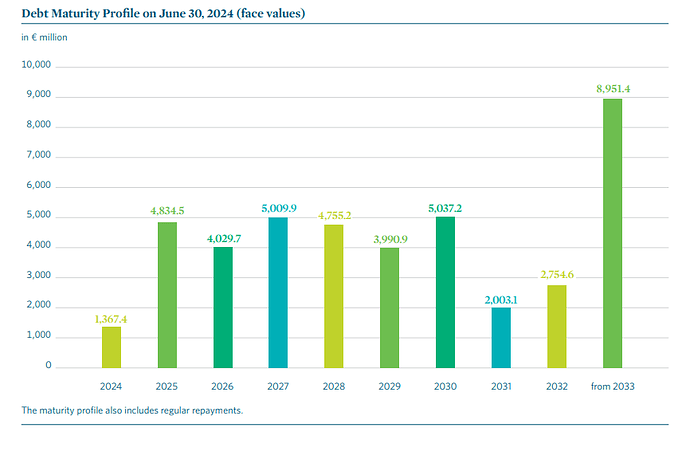

They have issued bonds worth €1.5 billion this year (H1 2024 report, page 7) and sold properties worth €1.5 billion. They are targeting to sell properties worth €3.0 billion in 2024. As at June 2024, it had €1.3 billion in cash and cash equivalents. That means its outstanding debt refinancing of €1.4 billion in 2024 is already covered. It is facing a debt maturity €4.8 billion in 2025. Therefore, though it seems to be managing its liquidity well, I think it will continue borrowing. Also, it’s expected to increase the pace of construction by around 1,500 units next year (from the current 2,500-3,000), which means it will need more cash.