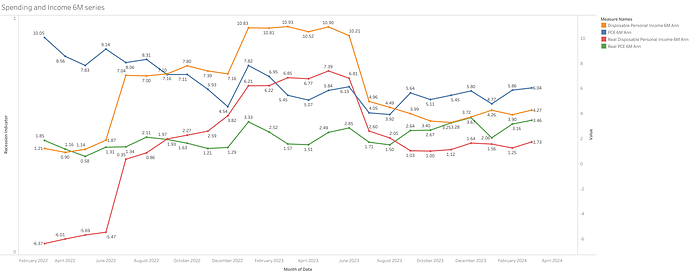

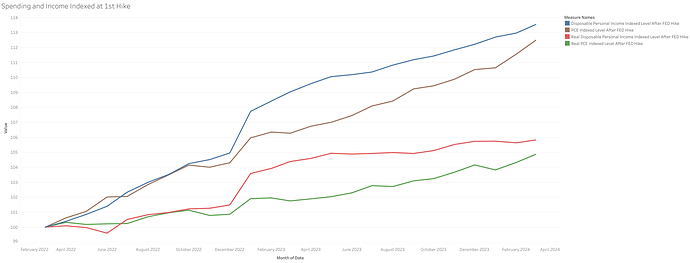

Consumer income and spending growth continued to be healthy during Q1 2024.

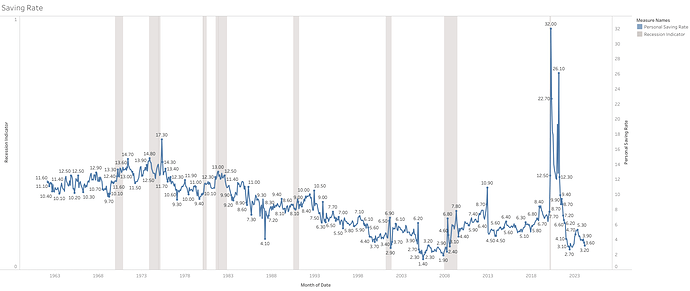

However, consumers continued to spend above their income growth, resulting in a very low saving rate at the end of Q1 2024.

This behavior in my opinion is not sustainable long term, especially as credit growth is also decelerating.

-

In Q1 2024, nominal spending grew 1.47% Q/Q (+277 B), and 5.05% Y/Y.

-

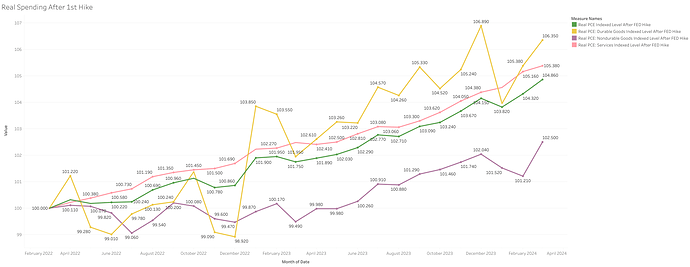

Growth concentrated on services, growing 2.31% Q/Q (292 B), and 6.72% Y/Y. Instead, goods decreased by -0.24% Q/Q (-15B), 1.75% Y/Y.

-

Most of the growth is mostly being driven by inflation, since real spending increased only 0.62% Q/Q, 2.42% Y/Y.

-

Nominal disposable income grew 1.10% Q/Q (226 B) in Q1 2024, and 4.31% Y/Y.

-

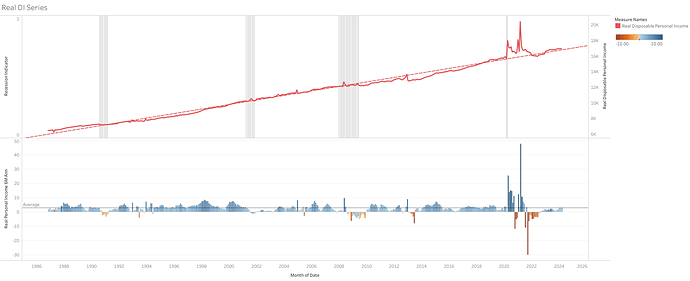

Income growth comes mostly from compensation (224 B), and government transfers (133 B). That’s why employment and fiscal spending are key metrics currently.

-

Real disposable income grew only 0.3% Q/Q in Q1 2024, and 1.7% Y/Y.

-

The saving rate ended Q1 2024 at 3.2%, an historically very low level. Before the pandemic 6-7%.

Data: Economic Model - Google Sheets

Tableau: https://public.tableau.com/views/USConsumerIncomeandSpending/RealSpeningandIncomeCurrentTrend?:language=en-US&:sid=&:display_count=n&:origin=viz_share_link