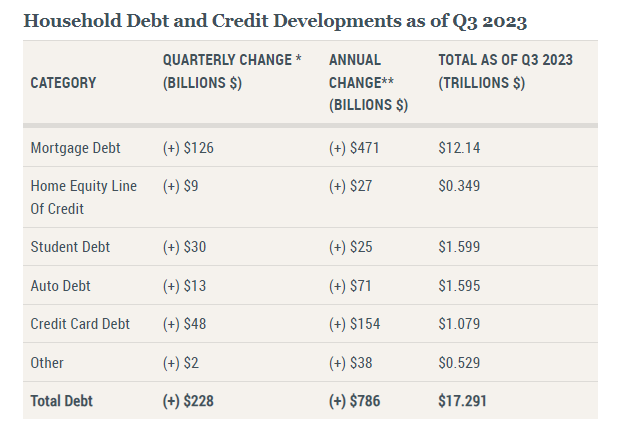

Significant increase in consumer debt during Q3, being led by mortgage debt.

“Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth,” said Donghoon Lee, Economic Research Advisor at the New York Fed. “The continued rise in credit card delinquency rates is broad based across area income and region, but particularly pronounced among millennials and those with auto loans or student loans.”

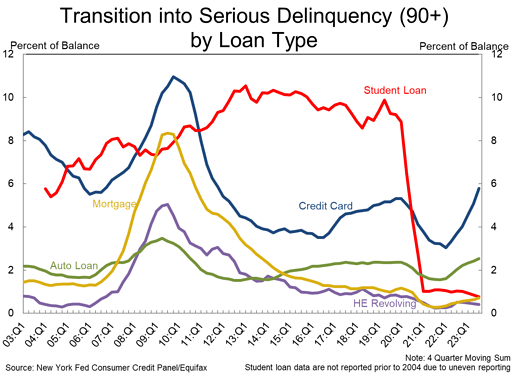

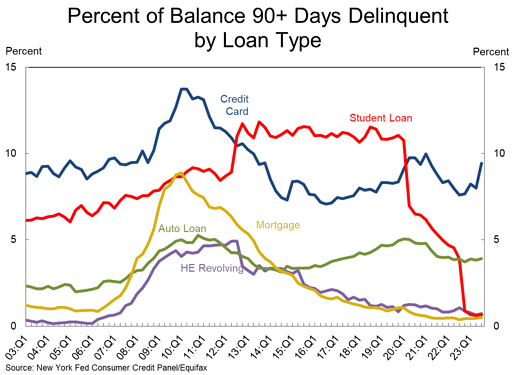

Transitions into new and serious delinquency continue to increase, especially for credit cards and autos, above pre-pandemic levels. However, despite the increase the total percent balance for serious delinquencies continues to be below it for now.

Interesting to me is that this sharp increase in transitions, was also experienced before 2008/2009.

https://www.newyorkfed.org/newsevents/news/research/2023/20231107