Main Article: Conference Board Leading Index - InvestmentWiki

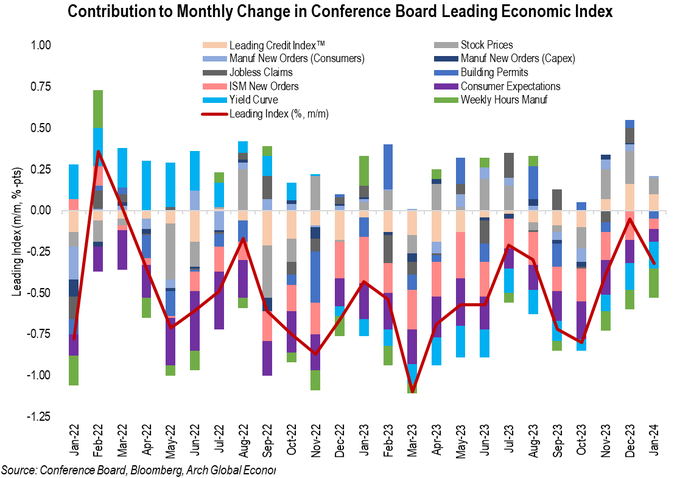

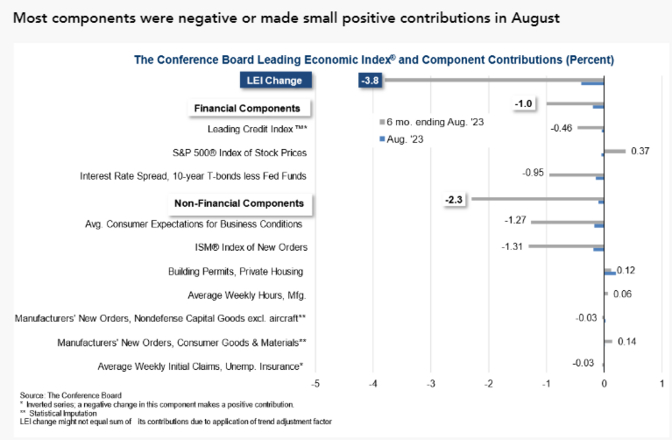

The LEI for the U.S. declined by 0.4 percent in August 2023 to 105.4, following a decline of 0.3 percent in July. The LEI is down 3.8 percent over the six-month period between February and August 2023—little changed from its 3.9 percent contraction over the previous six months.

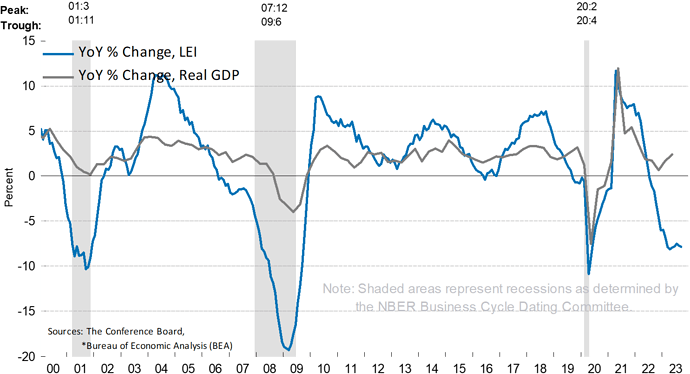

“With August’s decline, the US Leading Economic Index has now fallen for nearly a year and a half straight, indicating the economy is heading into a challenging growth period and possible recession over the next year,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board The Conference Board forecasts real GDP will grow by 2.2 percent in 2023, and then fall to 0.8 percent in 2024.”

The LEI for the US fell again in September, marking a year and a half of consecutive monthly declines since April 2022.

Declined by 0.7 percent in September 2023, following a decline of 0.5 percent in August. A 0.4 declined was expected.

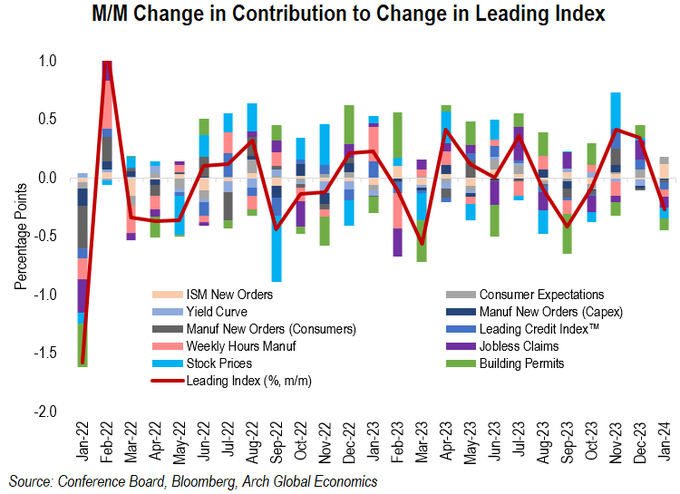

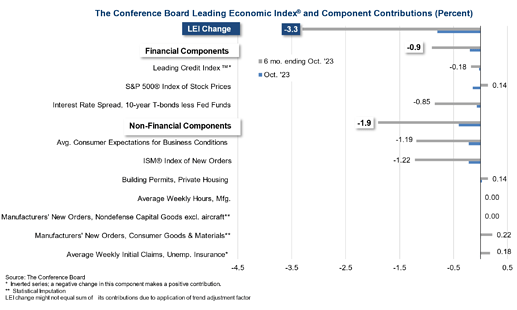

“In September, negative or flat contributions from nine of the index’s ten components more than offset fewer initial claims for unemployment insurance. Although the six-month growth rate in the LEI is somewhat less negative, and the recession signal did not sound, it still signals risk of economic weakness ahead. So far, the US economy has shown considerable resilience despite pressures from rising interest rates and high inflation. Nonetheless, The Conference Board forecasts that this trend will not be sustained for much longer, and a shallow recession is likely in the first half of 2024." Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board.

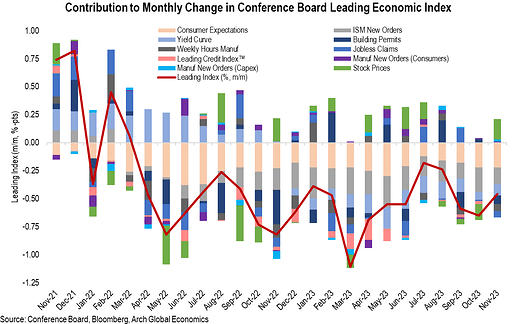

Leading Economic Index (LEI) fell by -0.8% m/m in October (-0.7% expected), keeping year/year rate deeply negative (-7.6%), but stable in recent months.

“The US LEI trajectory remained negative, and its six- and twelve-month growth rates also held in negative territory in October. After a pause in September, the LEI resumed signaling a recession in the near term. The Conference Board expects elevated inflation, high-interest rates, and contracting consumer spending—due to depleting pandemic saving and mandatory student loan repayments—to tip the US economy into a very short recession. We forecast that real GDP will expand by just 0.8 percent in 2024.”

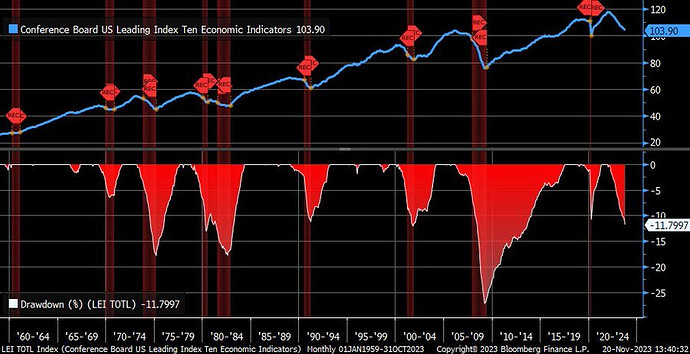

Interesting chart, LEI drawdown is on par with most avg recessions, and far below the few softlandings we have experienced in the past.

https://twitter.com/LizAnnSonders/status/1726712710312886592

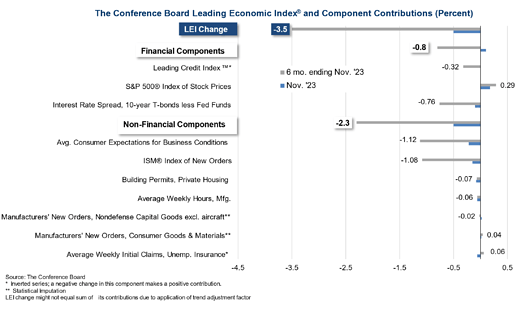

Leading Economic Index (LEI) from fell 0.5% month/month in November, and year over year is still negative at -7.6%.

“The US LEI continued declining in November, with stock prices making virtually the only positive contribution to the index in the month,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board.

“Housing and labor market indicators weakened in November, reflecting warning areas for the economy. The Leading Credit Index™ and manufacturing new orders were essentially unchanged, pointing to a lack of economic growth momentum in the near term. Despite the economy’s ongoing resilience—as revealed by the US CEI—and December’s improvement in consumer confidence, the US LEI suggests a downshift of economic activity ahead. As a result, The Conference Board forecasts a short and shallow recession in the first half of 2024.”

https://twitter.com/Econ_Parker/status/1737858662721556719/photo/1

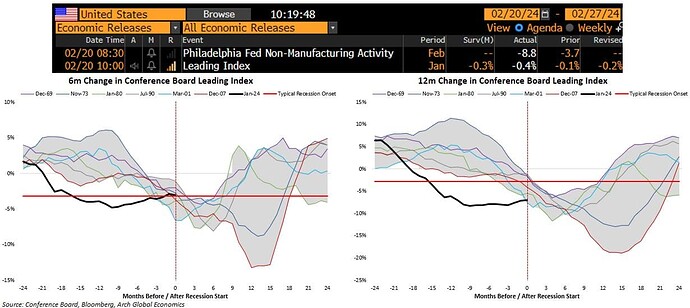

January Leading Economic Index from fell by -0.4% month/month vs. -0.3% est. & -0.2% in prior month

Conference board continues to forecast weaker economic activity, but has removed the recession forecast for 2024.

While the declining LEI continues to signal headwinds to economic activity, for the first time in the past two years, six out of its ten components were positive contributors over the past six-month period (ending in January 2024). As a result, the leading index currently does not signal recession ahead. While no longer forecasting a recession in 2024, we do expect real GDP growth to slow to near zero percent over Q2 and Q3.

- The LEI contracted by 3.0 percent over the six-month period between July 2023 and January 2024, a smaller decrease than the 4.1 percent decline over the previous six months.

- The year-over-year change has improved to -7% in Jan from the recent low of -8.3% back in Apr '23.