From the Quarterly Banking Profile:

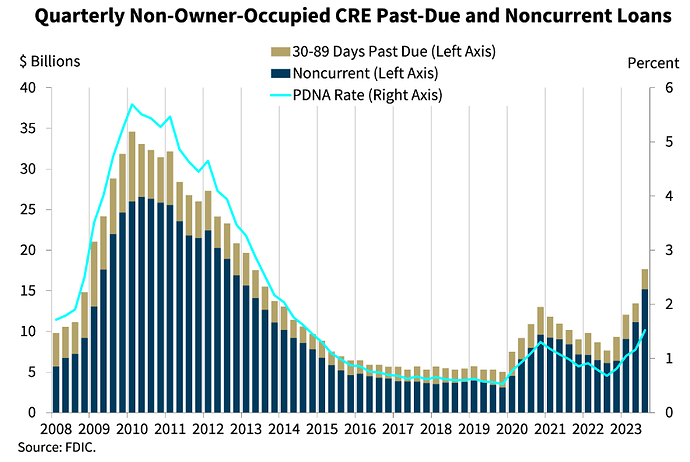

Looking more closely at commercial real estate portfolios, we are beginning to see concerning trends in non–owner–occupied property loans. The volume of noncurrent non–owner occupied CRE loans increased by $4.1 billion, or 36.4 percent, quarter over quarter. In addition, these loans had a noncurrent rate of 1.31 percent in the third quarter, up from 0.96 percent last quarter and 0.54 percent a year ago. This is the highest noncurrent rate reported for this loan portfolio since third quarter 2014.

These trends are being driven primarily by deterioration in office loans.