Meta beat revenue estimates in Q3, provided a conservative guide for Q4, and said its CapEx expectations have risen

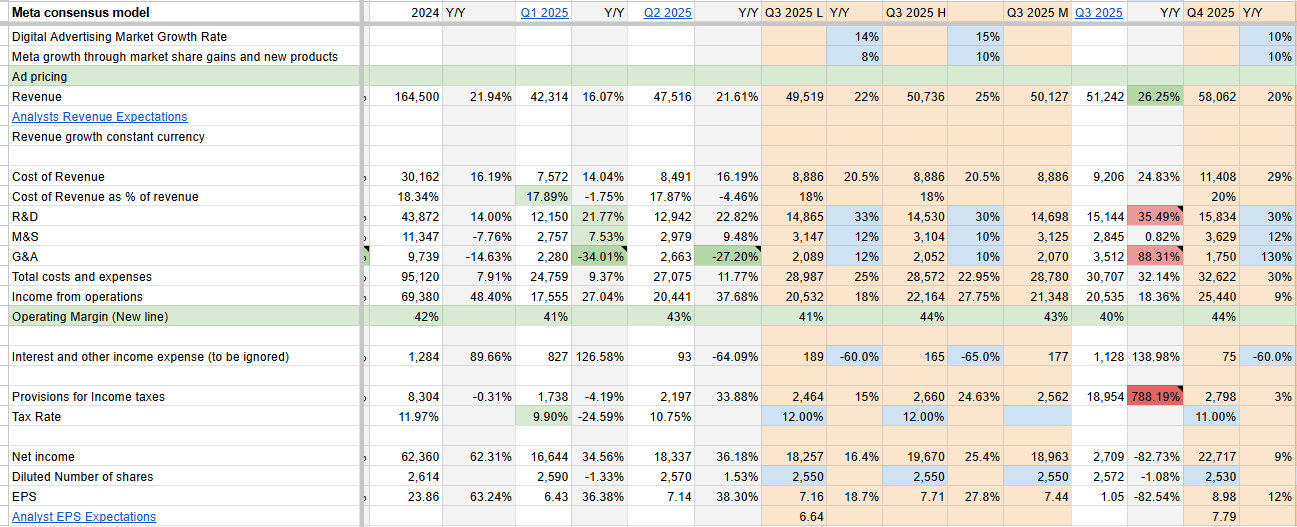

- Meta’s Q3 2025 revenue rose 26% y/y to $51.24 billion, above management’s upper guidance of $50.5 billion and analysts estimate of $49.57 billion while operating margin of 40%, was roughly in line with analysts estimate of 39.3%.

- EPS came in at $1.05, impacted by a one-time, non-cash income tax charge of $15.93 billion. Excluding the charge, EPS could have been $7.25, above analysts estimate of $6.72.

- Family daily active people (DAP) rose 8% y/y to 3.54 billion, versus analysts estimate of 3.48 billion, ad impressions grew 14% y/y (Q2 2025: +11%), above analysts estimate of +10.8% while average price per ad increased 10% y/y (Q2 2025: +9%), in line with analysts estimate.

- Meta is guiding Q4 2025 revenue in the range of $56-$59 billion, (analysts estimate: $57.2 billion), 2025 total expenses in the range of $116-118 billion (increased from $114-118 billion) and CapEx in the range of $70-72 billion (increased from $66-72 billion).

- Meta expects 2026 y/y expense growth rate to be significantly higher than the 2025 expense growth rate driven by infrastructure costs and employee compensation.

- It also expects 2026 capex growth rate to be notably larger than in 2025, pointing that their compute needs have continued to expand meaningfully, including versus their expectations in the last quarter.

- Meta said their discussions with the EU Commission regarding the Less Personalized Ads offering is constructive but they cannot rule out further changes to their model that could lead to significant revenue headwind as early as this quarter.

- Meta also flagged a number of youth-related trials in the US in 2026 that it say may result in material loss.

Assessment

Despite the higher than expected total costs and expenses, Meta Platforms delivered another strong quarter. However, shares fell 7% following the report, likely due to Q4 2025 guidance coming in below the overall analyst consensus. Given the highly bullish sentiment surrounding Meta ahead of earnings, such conservative guidance may have been perceived negatively by investors. The decline may also reflect concerns about rising capital expenditures coupled with negative sentiment related to U.S. youth-related legal cases.