@Magaly since you are asking some questions that could be interesting for everyone i thought this could be a good moment to switch the discussion to a bit more public place in the forum.

This also allows us to test the forum more extensively while avoiding that too much content get’s “buried” in Discord.

You can find the start of the discussion here on Discord.

Discussion in Discord

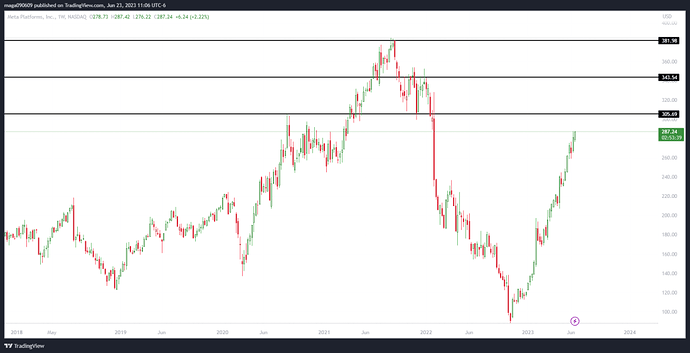

will you take Meta profits if it gets to $300?

-

@MagalyNH6

@MagalyNH6

will you take Meta profits if it gets to $300?

Pirate Captain — Today at 6:45 PM

It depends on our findings of the above mentioned topic, the state of the economy, our assessment of small businesses etc

- [6:46 PM]

What are the major resistance lines you are seeing?

-

@Pirate Captain

@Pirate Captain

It depends on our findings of the above mentioned topic, the state of the economy, our assessment of small businesses etc

MagalyNH6 — Today at 7:07 PM

I just think it could reach it before their is more certainty about that.

-

@Pirate Captain

@Pirate Captain

What are the major resistance lines you are seeing?

MagalyNH6 — Today at 7:09 PM

305 and 340 maybe. It basically has had none since $225

2

-

@MagalyNH6

@MagalyNH6

305 and 340 maybe. It basically has had none since $225

Pirate Captain — Today at 7:28 PM

What about current levels? Do you think appox. at $287 there could be a resistence at well?

-

@MagalyNH6

@MagalyNH6

I just think it could reach it before their is more certainty about that.

Pirate Captain — Today at 7:34 PM

Unless we find some strong red flags or data that suggest negative surprises i will be hesitant taking profits. AI seems to be a very strong theme and a wave that can surfed for some additional times as businesses get reevaluated. Additionally i believe we are only now beginning to approach more reasonable and neutral valuations levels from a fundamental point of view. Meta is not ultra cheap anymore but also not crazy expensive.

-

@Pirate Captain

@Pirate Captain

What about current levels? Do you think appox. at $287 there could be a resistence at well?

MagalyNH6 — Today at 7:41 PM

Yes, around that, is the end of the crazy gap that happened in 2022. But is probably weaker.

1

-

@Pirate Captain

@Pirate Captain

Unless we find some strong red flags or data that suggest negative surprises i will be hesitant taking profits. AI seems to be a very strong theme and a wave that can surfed for some additional times as businesses get reevaluated. Additionally i believe we are only now beginning to approach more reasonable and neutral valuations levels from a fundamental point of view. Meta is not ultra cheap anymore but also not crazy expensive.

MagalyNH6 — Today at 7:42 PM

What metric do you use for your valuation assessment? I have heard fears of a AI bubble, like the internet one. But short term this would mean crazy returns too.

-

@MagalyNH6

@MagalyNH6

What metric do you use for your valuation assessment? I have heard fears of a AI bubble, like the internet one. But short term this would mean crazy returns too.

Pirate Captain — Today at 8:02 PM

My main valuation metric is always P/E. I am expecting some bullish catalysts for EPS of Meta in the near term from things like

- Effects of cost cutting reaching the button line

- Higher ad impressions as both Instagram and FB are getting better through AI and short form video and people spend more time in them.

- Higher ad engagements due to already incredibly good matching of advertisers with people which i expect to improve further (Short form video is perfect for rapidly training an ai on what people like)-> Higher ad prices → Raising margins for Meta → Higher EPS. If you take Metas Metaverse investments into account, which they could reduce at any time Meta EPS is already very high. I think i wrote something about that shortly after the release of last quarters numbers. Additionally i am very bullish on the monetization potential of Apps like Whatsapp. (Probably wrote something about that before as well + a few more bullish reasons from september last year can be found in old sheets like here (1) or in the Wiki.) Overall we need to improve a lot in communicating the investment thesis and eventually displaying it in a compelling way to the community so it is good that you are asking questions. Eventually i even want to attempt do model certain impacts and play around with numbers more like

- How much exact eps impact are we expecting from cost cuts

- How will Metas margin develop in different ad impression and pricing scenariosetc. The closer we are getting to valuations i consider approximately neutral, the more important is this. (1) https://docs.google.com/spreadsheets/d/1UNG7ddMmZnKZK-Q0ePI1yPcKyutXw05gb3xVpS3jDJ8/edit#gid=595611303&range=A104

Access Google Sheets with a personal Google account or Google Workspace account (for business use).

- [8:04 PM]

The great thing for transparently + effectively communicating investment reasons is also that false assumptions can be discovered and challenged way easier

@Aron I will close the Meta channel in Discord temporarily. This means that all regular activities like posting news should be done in this topic.

(Note: The great thing about Discourse is that topics can always be broken down. If we realize that we want to have two Meta topics one for discussions and one for news we can still separate the two in hindsight)