Impact of potential trade tariffs proposed by Trump

Trump is leveraging the proposed tariffs (25% on Mexico and Canada, and 10% on China), in my opinion as a negotiation tool. Currently, these tariffs are not expected to be implemented (he is probably too aware of the negative consequences) but are instead being used to pressure Mexico, Canada and China to present solutions or proposals that align with his demands.

Based on his first term, we know that Trump can follow through on such threats of tariffs, making IMO these proposals more than just empty threats.

It’s also important to recognize the significantly different economic context today compared to 2016. At that time, inflation was very low, and interest rates were near zero, offering more room for maneuver. Today, inflation remains above the 2% target, with upward risks to inflation expectations, already elevated interest rates, and on top of that fiscal debt already 120% of GDP. In this environment, any additional inflationary pressure, such as that caused by tariffs, could have a much greater impact on the economy.

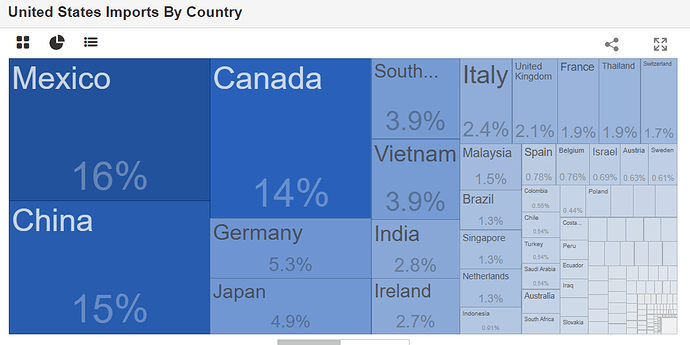

These 3 trading partners represent about 45% of imports into the US (1.36 Trillion in 2023). So, If put in place, these trade tariffs would have a negative impact on inflation and on economic growth. Some of the consequences of tariffs are 1,2:

- Protectionism reduces labor efficiency and overall economic output by creating distortions in the allocation of resources.

- Protection from foreign competition diminishes the need for domestic industries to improve, reducing long-term competitiveness and investment in innovation.

- Protected industries, often less efficient, gain market share, reducing overall economic output and productivity.

- Tariffs can raise prices across the economy, potentially leading to inflation unless monetary policy offsets these effects.

- By increasing the costs of goods, tariffs could reduce consumers’ purchasing power, leading to lower spending, investment, and labor participation.

- Tariff hikes could result in small but noticeable increases in unemployment rates. This aligns with reduced productivity and economic activity.

- Higher tariffs often lead to real exchange rate appreciation, which can offset any potential gains from improved trade balances, making exports less competitive internationally.

- Other countries are likely to respond with their tariffs on U.S. exports, further decreasing U.S. output and incomes.

- Tariffs contribute to higher income inequality as they tend to benefit specific industries or groups at the expense of the broader economy.

The extent of the impact is still too early to know since this was only announced today, but we will probably get reports from experts in the coming weeks about the potential specific impacts.

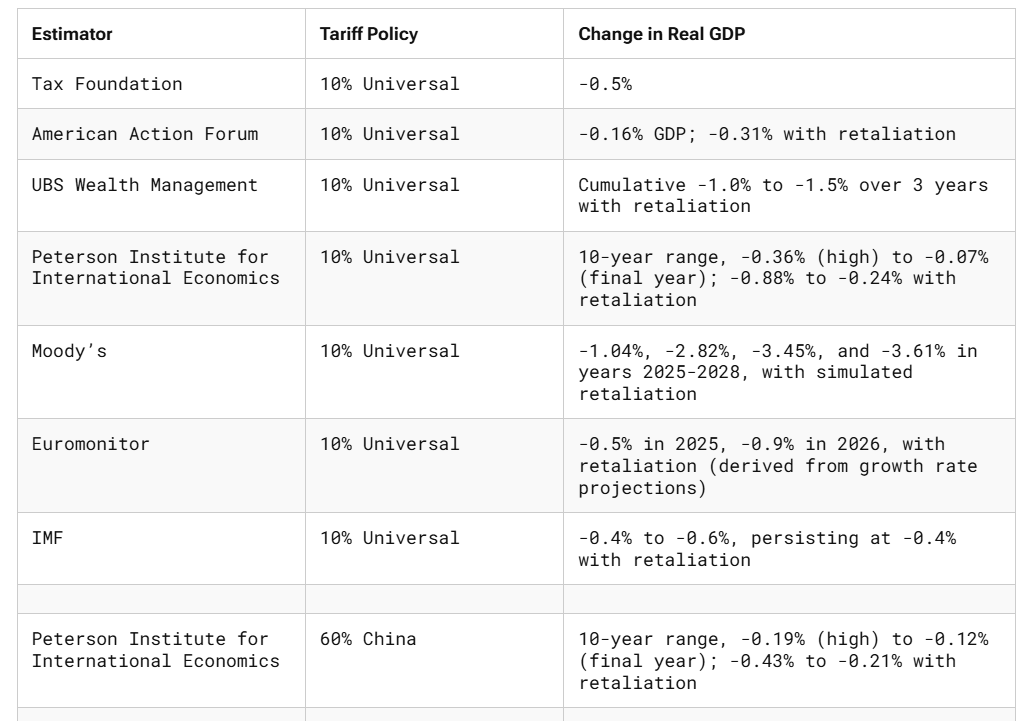

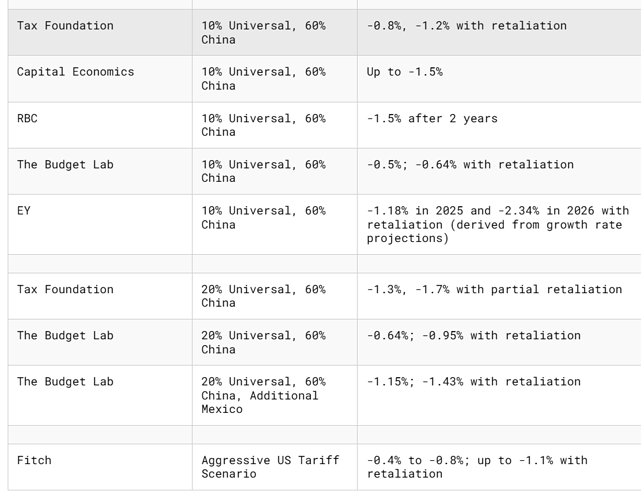

Some old reports about the previous proposals give some light on the potential impact

-

GDP would be negatively impacted in the long run by a range of -0.5-1.5% based on several estimates

-

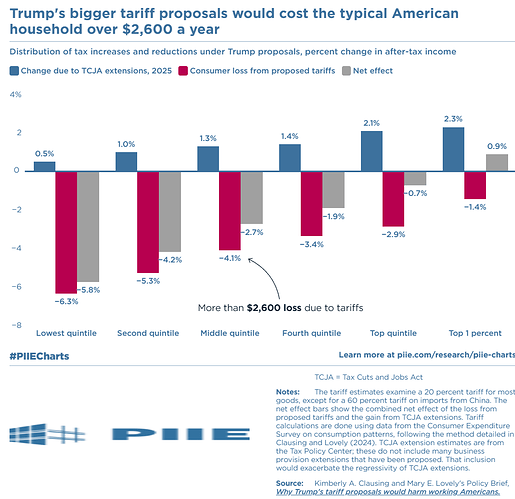

The negative effects on consumers, particularly those in lower-income quintiles, are expected to more than offset the benefits gained from the extension of tax cuts. While the new proposed tariffs are likely to have a more moderate impact, approximately half or less, they will likely still offset much of the positive economic effects generated by the tax cuts.

-

The impact on inflation will largely depend on exchange rate movements, as a strengthening of the dollar could fully offset the price increases associated with higher import costs.

-

Trade tariffs would not raise enough revenue to offset the revenue loss from the extension of the tax cuts. So, the US budget would still get hurt.